The Internal Rate of Return (IRR) is a fundamental measure of investment performance in commercial real estate. Understanding the specific sources of this return—whether from operational cash flows or from the sale of the property—can provide deeper insights. Partitioning the IRR allows investors to dissect the overall return and understand the contributions of each cash flow component. In this guide, we will explore how to effectively partition IRR using a straightforward example.

Step 1: Calculate the Overall IRR

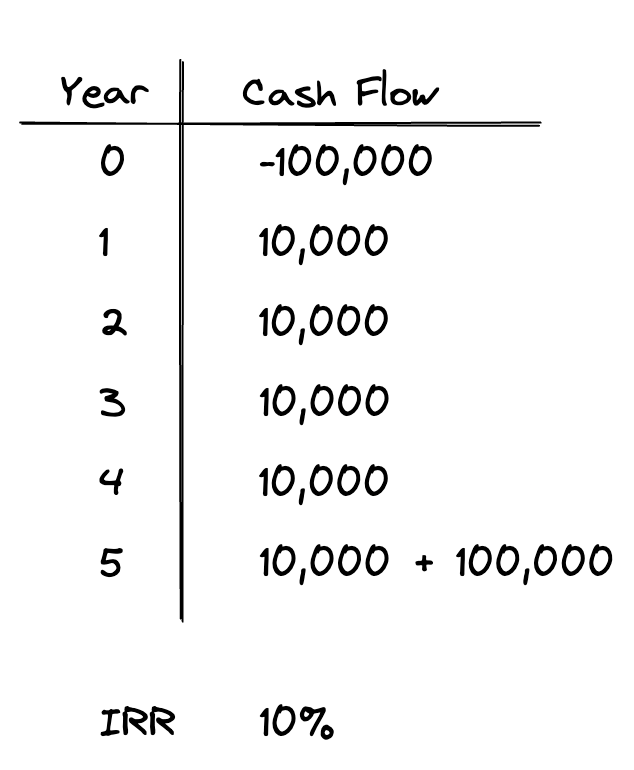

The first step in partitioning the IRR is to calculate the IRR for all cash flows associated with the investment. This represents the overall IRR, considering both operational income and the eventual sale of the property. For instance, suppose we have an office building investment with the following expected cash flows:

Based on an upfront investment of 100,000, the building generates a cash flow of 10,000 annually, selling for net proceeds of 100,000 at the end of year 5. Upon calculating the IRR, we find an IRR of 10%.

Step 2: Calculate the Present Value of Operational Cash Flows

Next, calculate the present value (PV) of each operational cash flow using the IRR calculated in Step 1 as the discount rate. Each cash flow from renting out the property is discounted back to present value using the IRR:

It is crucial to use the IRR from Step 1 for these calculations, as we aim to determine the contribution of operational cash flows to the total return versus the sale proceeds.

The formula for calculating the present value of each cash flow is:

Step 3: Calculate the Present Value of the Sale Cash Flow

Next, calculate the present value of the cash flow from the sale. This cash flow is also discounted back to present value using the IRR.

The formula to calculate the present value of the net sale proceeds is:

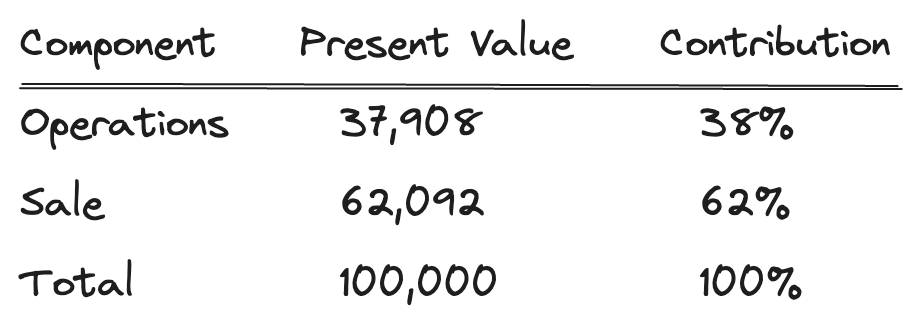

Step 4: Sum the Present Values of Operational and Sale Cash Flows

Now, sum the present values of operational cash flows and the sale cash flow. The total present value should match the initial investment, confirming the IRR calculation’s accuracy.

Since the combined cash flows total 100,000, we confirm the IRR is correct, indicating a net present value of zero.

Step 5: Calculate the Percentage Contribution of Each Partition

Finally, calculate the percentage contribution of operational cash flows and sale proceeds to the overall IRR. This percentage calculation provides valuable insight into the performance contribution of both elements.

The partitioned IRR is summarized in the following table:

Conclusion

Partitioning the IRR provides deeper insights into where returns originate, enabling informed decision-making, better risk management, and tailored investment strategies. By following the outlined steps, you can effectively partition the IRR for your own real estate investments.